Pretend you were planning a drive from New York to Los Angeles. You have to be there in 6 days, and with the expectation of driving 10 hours/day, it will take you 4 days to do it.

Google maps offers you several options, and all of them are well within your time schedule. But as you drive, you decide to take it easy and stop for extra meals, stop at a few tourist traps, visit a friend from school and hit up a Cardinals game because you've always wanted to see Busch Stadium.

Day 6 rolls around and you barely make it in time. You're stressed. The car is a mess. You have been driving 2 days straight at 14 hours/day (and picked up a speeding ticket in Arizona) because you didn't follow your initial gameplan.

And while this hypothetical situation sounds ridiculous/unrealistic to most of you, the greater percentage of traders do it every single day in front of their screens.

Admittedly, many traders don't even include step 1 in their approach (the trading version of Google Maps) and opt to just “try things out” and see what sticks.

A lack of cohesion to predefined rules of any strategy – or just a lack of them – is a devastating problem and oftentimes incorrectly addressed.

I became obsessed with all things technical analysis many, many years ago now. It was an obsession that I'm sure some of you have experienced, whether it be technically-oriented or otherwise. I want to know it all. From the most macro of movements right down the ones taking mere milliseconds to execute.

Through this obsession I was introduced to a heap of studies which provided piles of theoretical context. Sifting through it all took an enormous amount of my time, time which, I'll of course, never get back. These days I'm quickly dismissive of certain types of studies, because I know full well that I'll never use them successfully. Among these are anything exponentially calculated (your standard MACDs, Bollinger Bands, etc….the list is enormous). These are by all definition old school indicator types that flat out don't mesh with my general “state”.

Hands down the most common indicator types, like the ones mentioned above used in professional strategies, entail regression of some form but rarely in what most people would consider the traditional sense. The great divide between professional and amateur remains wide open as ever.

Perfection Is For Crazy People, Kind of Like Yours Truly

I'm a perfectionist when it comes to many things, and I don't think trading is any different. I get flat out angry when anomalous events stop me out of a trade because I had zero control over them.

But if you want to see me outright furious, just watch what happens when I fall outside of my predetermined set of rules.

I, like most people, seek out structure in certain events, with a series of qualifiers to back them up. My “shortlist” looks something like this:

- Room to run – need enough future yield on the position for it to make sense from a risk perspective.

- Intended target – decided first, entry second. Typically trading into an area of larger liquidity (from a price action perspective, these are typically centered around a previous range / where price spent a substantial amount of its time) or fading an area of small liquidity (again from a price action perspective, an area which has consistently rejected price)

- Price action structure – there are several reversal / continuation structures that need to present themselves. Its either a trade to complete one on a larger timeframe or fade of a smaller one found in a larger, unidirectional movement. Additionally, fades need to come from historical areas of rejection (aka low volume areas)

- Carry-through behavior and volume – has to be there or we flat out go no where

- Shape of the book – a discussion unto itself, but the weight of the order book is predictive of future movements

- Structure of recently executed trades – who's buying/selling what and where? Am I on their side or basically “fighting” them (in which case I lose)

It's like riding a bike after a while.

When I hear the KISS advocates watering down a strategy to a couple nuts and bolts, while completely chalking up losses to “well, that's trading….just the way it goes” then yes, that's beyond frustrating to listen to.

The fact of the matter is, what we don't know drives us nuts, and I am the first to admit that getting crazy is not a good thing (but can fuel overall drive). But most people duck under the wire many, many times before he/she can take off the training wheels.

Once you find your groove, it sticks around.

I always wanted to be that guy that kills it, day in and day out. Who has time to sit through a bunch of losers? In it, my brain swelled with knowledge but it rarely helped me move ahead. I am a mini-walking encyclopedia when it comes to trading topics, but ask me what percentage of that has actually had a positive impact on my P&L, and I can tell you that I have “wasted” an enormous amount of my time. And then again, you don't know until you see it with your own eyes.

If I could go back and do it all over again, I would set up a permanent google search that only gave me results from academic and corporate literature, and go from there.

Moving Ahead Entails Something Totally Different

If you go to any major hedge fund (that's actually turning a profit), you will be shocked at how oftentimes, portfolio managers know so little about standard market mechanics, or other topics on which you might currently be placing a high value.

Its because these men and women don't need to know it “all”. In many cases (obviously not all), they know what they need to keep their jobs and maintain productivity of the book.

And I see it on the retail scale as well. My encounters with traders doing it “right” usually doesn't entail vast knowledge of every single topic under the sun (and this isn't to be confused with a lack of knowledge either….far from it).

I've said this for many years now, these people I encounter are all well organized. They know their game and they stick to it. They don't learn a new idea, use it, have success the first day, then get smoked every day after that, and so on, until they black out and start all over again.

They review. They learn. Things that confuse them doesn't get them emotionally tangled. They take it slow. They keep emotion and fact like oil and water.

Buffet's Circle of Competence

Those of you familiar with Warren Buffet's idea of the “Circle of Competence” will immediately know what I'm talking about. You realize your proficiency, accept it, and don't rush to the finish line while breaking the mold over and over again. And I have mentioned on this site before that keeping it simple is never a bad way to go. But there is most certainly a thing as too simple. If you don't understand the basics of what's moving price, it is hard to get your head around a .01% day vs a 3% day. If large movements “seem like magic” then its time to study more (Warren Buffet reads appx. 5 hours every day, if that means anything to you).

Those of you familiar with Warren Buffet's idea of the “Circle of Competence” will immediately know what I'm talking about. You realize your proficiency, accept it, and don't rush to the finish line while breaking the mold over and over again. And I have mentioned on this site before that keeping it simple is never a bad way to go. But there is most certainly a thing as too simple. If you don't understand the basics of what's moving price, it is hard to get your head around a .01% day vs a 3% day. If large movements “seem like magic” then its time to study more (Warren Buffet reads appx. 5 hours every day, if that means anything to you).

I can tell I am disorganized when I take a lot of positions. Usually, it means I'm getting absolutely no where from a P&L standpoint. But all it really means is to get up, take a step back and start looking at the bigger picture. The market will still be there. It's going no where.

“What have I been doing vs. what do I need to do?”

Again and most typically, it's more of a broad study and sticking to parameters. The correction process usually doesn't take very long.

Where to Go

I can tell you that the many of the influential topics I've studied came from academic or corporate research and otherwise (what most people would consider) heavy-reading. Most of what I read cannot be applied 1 to 1, but there is tremendous value in the underlying theme. Being entertained, wowed, or fed a motivational spiel isn't going to do the trick. When someone tells you “if this support breaks, then it turns into resistance” and it doesn't, its because a pile of smoking guns fired off on the bottom from a low volume node but you missed it, because you weren't told to look at the right information.

But even with all of this, if you're not working with a predefined set of rules, you're going to get in trouble at one point or another.

So there's an obvious balance here. Understanding what works and why prices simply do what they do, and sticking to what you know. And I have never felt that one works without the other.

When you're new to trading, the most difficult component appears to be step 1 of the strategy development curve: finding what works. I believe this is why the majority of blogs, news sites and other places flood the market with “ideas” (I am no exception, by the way). But once you have this down, you have only made it past stage 1.

Time is Precious

And its why we implement strategies without full working knowledge of everything we're trading on a regular basis. Much of it just isn't necessary if a strategy is effective, and we are sticking to it verbatim. The problem, of course, is that most people don't.

My own knowledge dig is the result of worry, more than anything else. The more I know, the less I worry, plain and simple. If a strategy isn't working, I can pinpoint why in a very brief amount of time based on everything else out there. It is 100% impossible to predict everything under the sun. And this is why we work in probabilities, not levels of excitement.

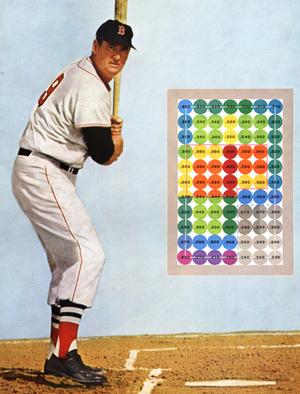

Working knowledge and using what we have go hand in hand. Most people don't have the stomach to search for home runs every single day, which is why we bunt.

Use what you know, and always keep learning. The world changes so much every day, and there is always more to absorb. And whatever you do, test, test, test. Believe it when you see it.