I have a ton of posts on my backburner here and just wanted to do some spring winter cleaning and push some of them out. As many of you know by now I'm a user of volume-based profile, which stems from the original works of market profile (which uses time, not volumes, as a constant). I lean on it for locations alone, and not its common perceptions as a tell-all.

These day opening types were originally created by Peter Steidlemeyer, and while my own view of profile vastly varies from (really any) of the market profile texts, these are one of the exceptions I look to on a regular basis.

Some quick background into why all this matters and why even bother……the open of any session is important to us for a few different reasons:

- Price has not yet found its value for the day, where value = most generally accepted price in terms of volumes (or time, if using market, not volume, profile). Because of this, movements are generally more exaggerated and as the session prolongs, value is more likely to be found (given the circumstances for the day, ie lack of late-in-the-day data, announcements, etc.). Thus, your opportunity for price movement gradually diminished and range-bound activity is more likely to occur later in the session.

- In line with the above, previously identified volume-based targets have a higher propensity to be hit sooner versus later.

- The first half hour of the day is typically dominated by a rush of orders waiting to be executed from overnight. We tend to start discover more direction in the second half hour of trading, with the entirety of the first hour referred to as the initial balance of the day. Thus, these day open types are typically realized within this first hour of trading.

- Statistically, price undergoes its greatest movements during overnight sessions. This is due to a lack of resting orders getting in the way of market/matched orders, posing less friction, thus easier range of movement. This is why any less liquid market will experience higher levels of volatility, and why announcements tend to do the same, as the order book becomes a ghost town dead ahead of data releases. Overnight activity can either continue or be corrected, and the opening type helps us identify, early on, which one it will be.

By classifying the opening type, we are giving ourselves a guide to subsequent activity. It's a framework. And while it is certainly not the tell-all, it is but one easy-to-identify component that can assist us in latching onto a prevailing movement, or keep us out of harms way in the event of a reversal (contingent on your strategy, whether it be divergent or mean reverting). Profile in any sense is largely structural, but nevertheless provides one with crucial details in regards to inflection points of any size, where prices will rest, breakout, target, etc.

The original sources for these are:

Peter Steidlemeyer: the earliest discussions begin as soon as page 21 in “Steidlemeyer on Markets” and continue through the book. While it has been a while since I have read it, I am hard pressed to tell exactly where they are referenced, in one shot. If anyone reading this can help, feel free to comment and let us know.

Jim Dalton later refined the definition of these and classified them in what some would consider to be a cleaner version. His writeup can be found in “Markets in Profile”, pages 171-181.

I encourage you to read both books, whether or not you plan on using their interpretations explicitly.

I don't. In fact many of the larger concepts I lean on, such as high volume node edges, receive no mention at all. The following are based on Dalton's classifications, which have become the most recognizable/discussed. This isn't to implicate some kind of bias or negativity toward the original works, quite the contrary, I just cannot relate to them verbatim.

So let's get on with it:

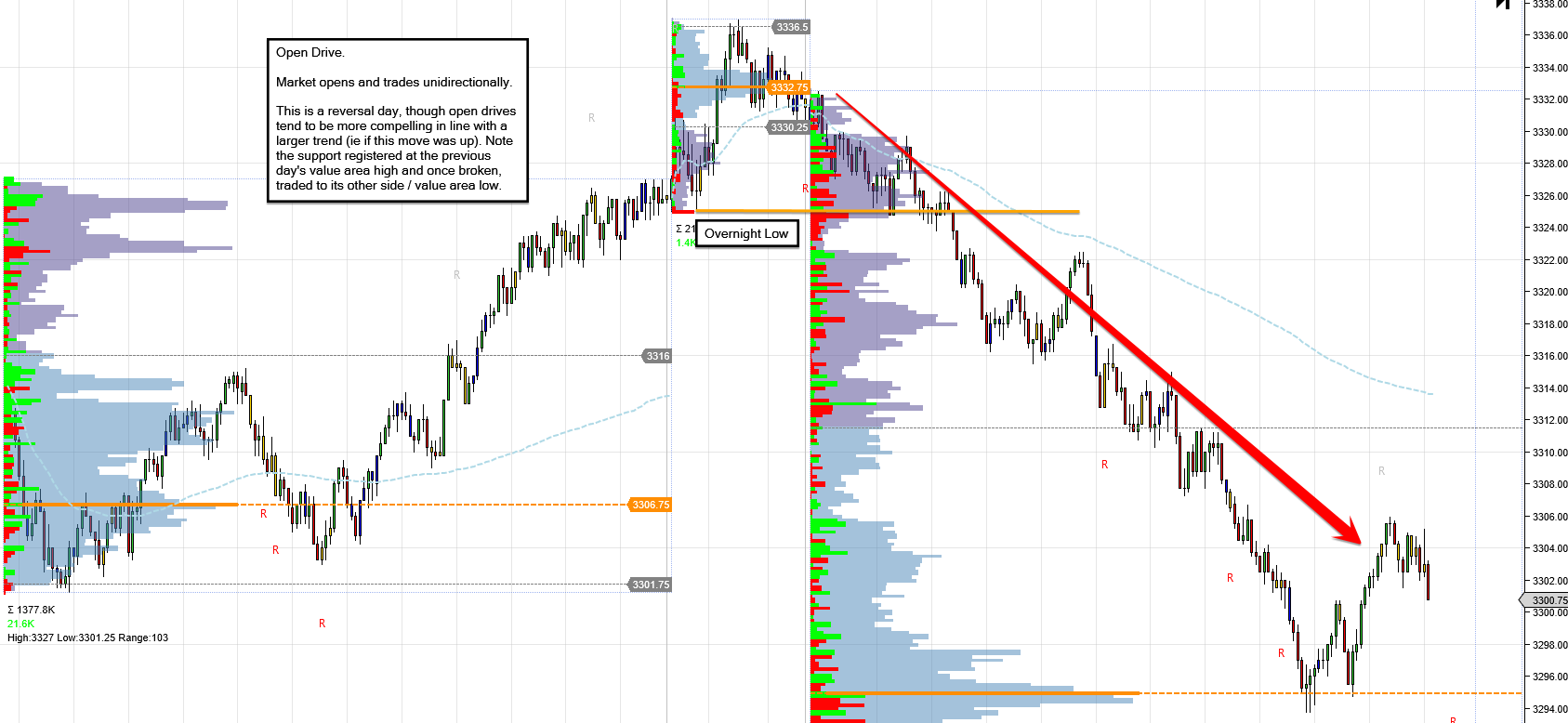

Open Drive:

Momentum-based opening. For a long: The market opens above the previous day value area and continues trading long, through the overnight high. One of the more the more telling types of opens and represents immediate strength. Reverse for shorts.

Like any level, the overnight high or other major reference points surrounding it has the ability to fail. Be aware of the fact that strength tends to dominate early in the session and as such, follow through has a higher tendency of occurring during this window in time. Seek out strong volumes with price immediately following suit for continuation.

The open drive is one of the more telling open types in terms of conviction.

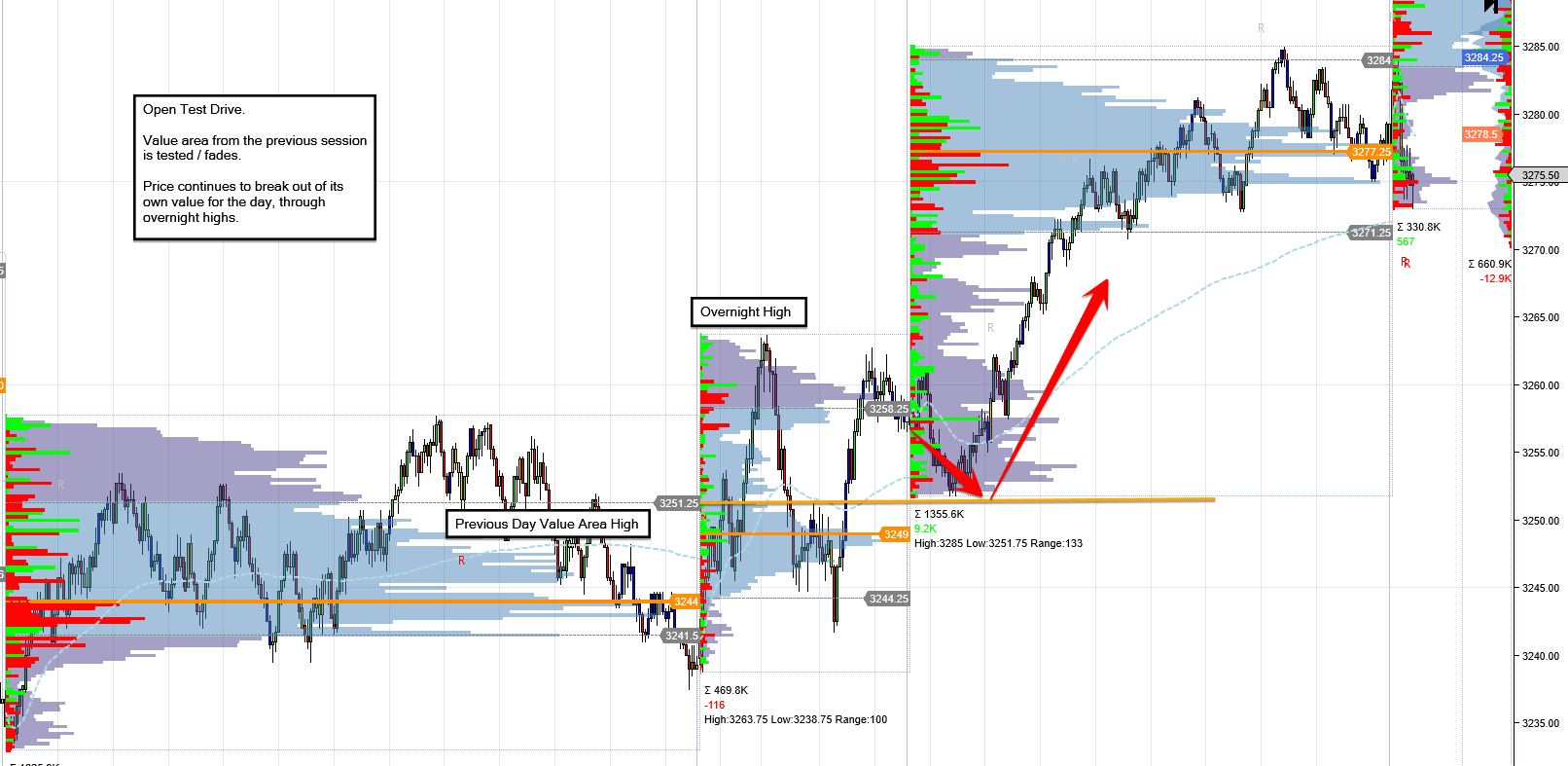

Open Test Drive:

Open Test Drive:

Another momentum-based opening. In a nutshell and for a long: The market opens above the previous day value area, pulls back to it, and remains above it. Longs can be executed at the value area high of the previous session, leading through to a breakout of the overnight activity.

This is essentially an pullback prior to a trend developing. These are less common just due to manner in which prices trade overnight.

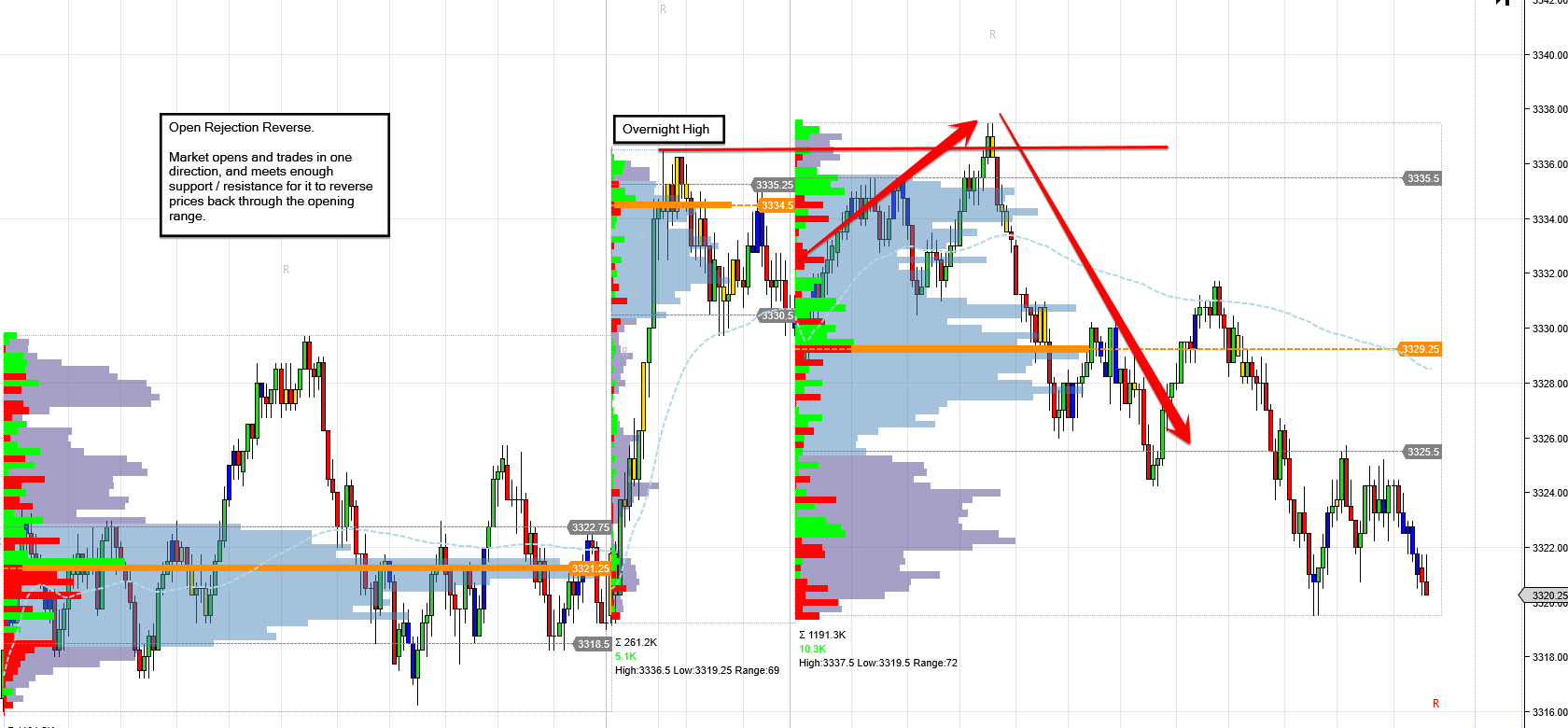

Open Rejection Reverse:

Open Rejection Reverse:

The easiest way to think of an open rejection reverse is a failure of an open drive.

The market moves to an important level (long term profile level, overnight high or low, etc.) and fails to continue momentum. A reversal occurs, usually accompanied by strong single instance delta divergence, and trades in the opposing direction of the initial movement.

From the books, when this occurs and price trades into the previous day's value area, you are expecting price to go the other side of it. I have found this not always to be the case and would rather rely on the opening type in and of itself as the early telltale.

Open Auction In/Out of Range:

Open Auction In/Out of Range:

This is an inconclusive market. Leads to consolidation. The market opens and a lack of conviction presents itself on either side.

“In range” refers to the market opening in the previous day's value area.

“Out of range” is the opposite, and price has opened above/below it and consolidates.

In either case, breakouts are anticipated thereafter. This is just common sense in the fact that prices contract, then move. When you see a D shaped distribution, be on your toes for a breakout.

When prices open out of range, the general, insinuated belief is that volatility will be higher vs. a day where prices open inside the previous day's value area. This may not be the case should prices move to an area also swimming with previously executed volumes, so as usual, everything matters. Those who sit down and start executing in seconds pay for their lack of comprehension in the end. Do your work.

And assumptions such as the one just mentioned are part of the reason I recommend anyone err on the side of caution when it comes to shaping your own opinions. All instances are reliant upon others, and our brains are trained in way where we store patterns, but only in the context of what we're looking at.

Price to support/resistance, price to fundamentals in any way, price to derivatives, price to technical indicators, price to volumes, etc. Start from scratch with any of these and your previous experience matters extraordinarily less. This is one of the reasons why strategy jumpers tend to struggle so much. Whether you are constructing an algorithmic strategy or trading one manually, it's all the same.

Common thinking leads most people to believe this is a process of predicting. I argue that this is a business that requires reacting as a primary skill.

We assume that because X occurs, Y must as well, when in fact Y could easily turn into Z in a matter of seconds. So regardless of your timeframe, you are looking at some assemblance of data and reacting to it as quickly as possible. When we observe something such as a day open types in order to gain a general consensus, or framework, for any given day. It is a precursor to momentum, or lack thereof.

An open drive, as an example, is a telling sign of early strength. This is a lot of volume pushing prices in one direction right out of the gate. Trading over value and in line with the movement simply poses less friction vs. attempting to stop the market freight train.

Like most things, once you become accustomed to seeking them out, they come quickly and without much in the way of over-processing. These are one item in a list of many of which I've personally found value, whether you choose to or not. The main purpose of this post is to make them easily referenced by way of volumes and raise awareness to those who have never before used them.