Many traders that are good at gauging market sentiment, global reactions, etc., are poor market timers, and it might be true that a lot of them never crawl their way out of this bubble.They get caught up in the fundamental inputs, economic data analysis, volume ratios, and eventually seem like better analysts than traders. They can talk their way through a conversation about Fed monetary policy but have a terrible time getting into the market when it counts the most. Conversely, you have technicians that can mark up every level imaginable on a chart, show strengths and weaknesses of underlying trends, demonstrate cyclical analysis, etc., yet get blown out because they are poor at gauging global responses to rumors, data, or any other factor driving the market.

But every once and a while, you find a trader that is a deadly combination of the two.They go on to become legendary traders – spoken to be the perfect balance between He-Man and corporate finance.Finding this balance is a complex subject, however, and those that “have it” never gain it overnight.Phases attack us over our careers, and many people end up getting stuck in “trader purgatory”, at least for some time.

In The Beginning….

In the world of day trading, we have a problem, and it starts at the beginning of our careers.As far as we can tell, the only purpose of technical analysis is to accurately time the market, but not take over an entire means of perceiving it.I made an attempt to gauge industry input by doing a quick book search for the term “daytrading”, and came up with the following results:

7 of the top 10 book results focused on technical analysis as the primary or only weapon to use in order to trade.Out of the other 3, 2 of them covered it in about half of the book, the other one was solely based on fundamentals centric to a specific market.And of course, included in the titles of these books were some of the following terms: “Guaranteed Income”, “Big Profits”, “How to Profit”, “Make Money”.It’s a greed machine, I assume driven by primarily the publishers because admittedly money is a lot more attractive than a chart of the dollar index.

Groupthink And Technical Guides

I have always been critical of longer-term technical analysis, simply because the landscape of ideas, opinion and data injected into this market can change so rapidly.Using these past few weeks and events tied to EUR/USD as an example:

….this list could keep going but simply stated: none of these items have anything to do with technical analysis.They are all based solely on traders reacting to news releases or data events, providing an outline or premise of the direction of any particular trading period.They are the catalysts that lead to changing prices, the same ones dissected on charts in terms of technicals.

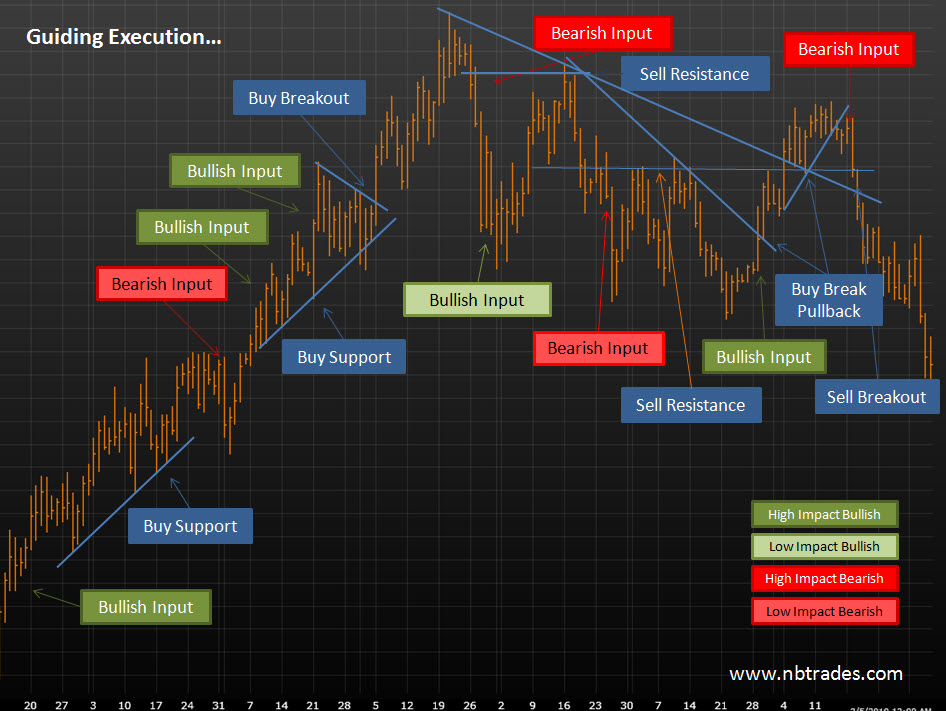

Technical analysis, in this sense, should be used as a reference only.It helps us to define entry point

s, stop losses and profit taking opportunities.Undoubtedly, it is hardly ignored in this or any other major market.One glance at a chart and it is quite easy to see the number of responses on support or resistance levels, derived by many different means, happening over and over again.They serve as the entry and exit points for traders throughout sessions…..they are a guide, or a shell, to all preexisting data mentioned above.They “build the house” but don’t control the people within it.

The “crowd” or major market participants that have the ability to move these markets are monitoring these levels in order to assess the possibility of price turning or following through.Major breaks on trendlines or key highs and lows can undoubtedly build momentum, as participants across the globe notice these shifts and in all essence, go with the flow.At the same time, a single news release of substantial impact can reverse these flows, as they are indeed the primary drivers of any market.

Blowout Forecasting

Forecasting through technical analysis typically takes advantage of loopholes or common “efficiencies” in the way price moves based on what has occurred in the past.When we rely on exponentially calculated indicators to tell us where price will pivot we are simply ignoring the primary drivers of the market.By using support and resistance levels we monitor that which everyone can see, exploiting opportunity in order flows based on underlying crowd psychology, underpinned by these events.

A while back we discussed automated trading, and I explained that one of the Quants at the hedge fund I was working for got plastered during the early days of the recession.With a sharp peak on the world equity markets, it apparently mistook an entire collapse of the stock market for a correction, buying and dumping all along the way until the strings finally got pulled and “Uncle” was cried.Including employee salaries, this is a system that cost millions of dollars to build and quite literally did about the same quality job as simply coded automated trading strategy built by an amateur in a dark room.

Not to sound like a complete random walk theorist, most of my work as a writer has been about technical analysis, but only surrounding the basics of support or resistance.For my general purpose and sense, levels are to be used only as a guide, nothing more and nothing less.They provide us with a visual reference from which to work and responses from them can provide us with more precise means of execution.

TMI – Too Many Interpretations

A lot of inexperienced traders want to know how the “big boys” trade.Well, some of them trade like idiots.Others, quite the opposite.No matter what level you are on or how much capital you have, keep in mind that we all have the equal ability to make mistakes, follow the wrong paths or do illogical things.Humans are humans.But by simply understanding the basics of what moves this or any other market we have our framework from which to build.

I try to keep things easy.Really, I do.If there is one thing I don’t like it is staring at a slew of mind-numbing data that serves me little purpose in the outcome of my bottom line.As I scour the internet every day looking for pieces of information that might help me or guide me, I almost always fall back on worldly interpretations on news articles, primary economic data and basic/globally visual technicals to enter or exit the market.

There is only so much information out there, but theories, interpretations, etc., of it can be thousands of time greater than the original.Typically, you will find most of the flows going in line with the most simplified interpretation.And if it’s not, make sure you didn’t miss something, because there is a good chance you did. People only have so much time to digest information, and they want to be able to react quickly enough to ensure they’re making a profit. And in times of uncertainty/doubt or confusion never forget risk management rule #1: don’t do anything at all.