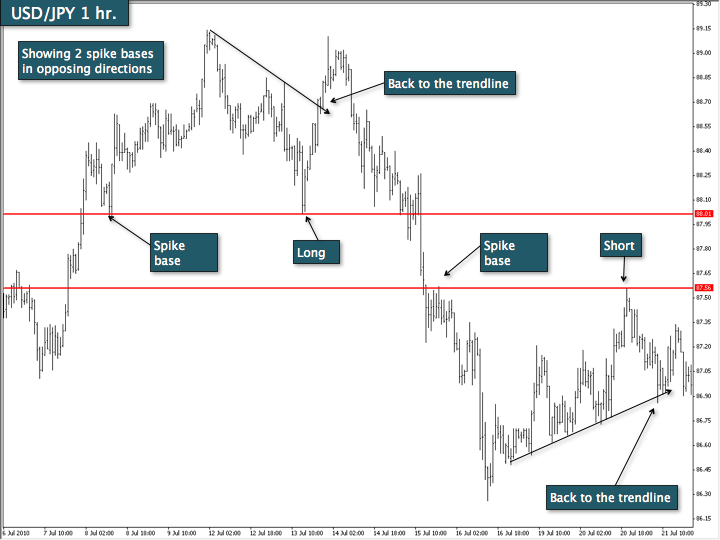

Following a spike, price will consolidate towards the highs. These work best when visible on larger timeframes, allowing more exposure to the rest of the world. When price retreats back down (or up), the bottom of the consolidation zone acts as support (or resistance) go long (or short) at the base of the initial spike's consolidation zone. These are best played on a 1 hour or greater timeframe, and “V” shaped charges, back into the level should be avoided. The consolidation zone is a prerequisite. Perhaps easier said,

1. Price spikes out of a consolidated range

2. Price pulls back, making a ‘flag' pattern

3. When price revisits the bottom of the flag, its used as support

Note that spike bases are local support only, meaning that once another leg is achieved (another spike), the level is nullified.

Once you start noticing them you'll see them quite often….they're a relatively common / repeating pattern.

Click any of the images to expand.