Update, 2023:

Welcome! This is the original, 2009 article for what (somehow) blew up and what became the infamous Quasimodo price pattern. It's short / succinct, but like all price patterns, there is not much to them. I did not think much of it at the time, because I have always viewed it as a simple reference structure, as I do to this day. Since this post was released, tons of videos and other articles have been made or written about it, which is essentially just the inception of a head and shoulders pattern. I've received countless emails over the years in reference to it, so I will summarize by saying this: like all price patterns, they are best used as navigational structures. Price percentage gain claims when using this as a standalone method, and other types of clickbait are typically anecdotal or otherwise completely bogus. There are price patterns (or anything else) and then there is execution. These are completely different things. So stay safe out there! There is far more to this endeavor you have chosen to undertake than highs and lows. All the best! -Steve

———

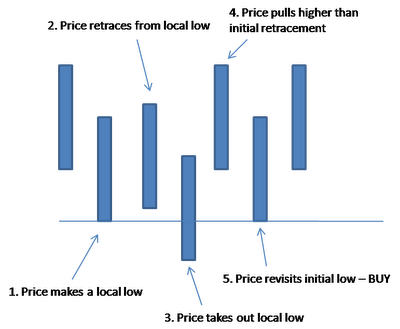

Another pattern we heavily monitor, serving as an intraday price turning point. These can be very reliable if used properly and can be seen on everything from daily down to 1 min charts.

The easiest way to describe this pattern is a 0-1-0 pattern, where in the case of a buy, price makes a new low; that low is taken out, price comes back up past the initial pullback from the first low, comes back down and uses the base of the first low as support.

Its essentially the inception of the very common head and shoulders pattern, without the diagonal trendline ambiguity.

Think of it as the top of a 2 dimensional pyramid made of squares, where the blocks on the second level from the top have equal highs.

In the case of a buy:

1. Price makes a new low

2. Price retraces from this low

3. Low is taken out to the downside (price extends beyond it)

4. Price comes back above the initial retracement from the first low

5. Price comes back down and fades the original swing point

The reason we require, in the case of a buy, a higher high on the second retracement, is to disqualify the current downtrend, and initiate a price reversal. Without the higher high, market participants could easily view the current price action as nothing more than a bump in a downtrend, as opposed to a reversal. Reverse this logic for sells.

Like anything else I list here, these are nothing more than patterns that repeat themselves all the time, and some of you might be aware of this one already. They key is to identify, and most importantly, react to them, when the opportunity arises.

If you're looking for more, here is another article on the subject: https://paracurve.com/2014/08/quasimodo-price-pattern-revision.html