Entry Points, Trading with Influential Participants & Price Action as a Supplement

It has been 3 years since posting a video to the public, but thought this was necessary given the evolution of markets, tools for analysis, and my own exposure to various methodologies. This site has

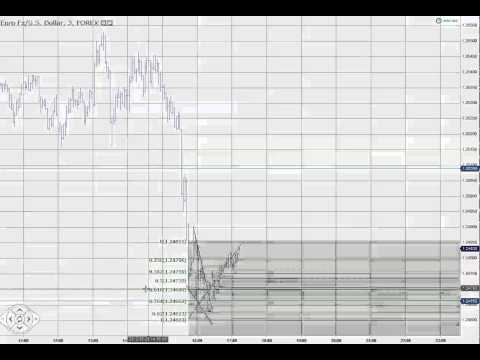

Ode to Fibonacci